File Your Own Tax Return - My Free Taxes

Tax payers with a household income of $79,000 or less are eligible. File your taxes for free online. MyFreeTaxes helps people file their federal and state taxes for free, and it's brought to you by United Way. This is the fastest option available to all income levels - it takes most filers an hour or less to file from the comfort of their own home or wherever you have internet access. CLICK HERE!

Have Your Taxes Prepared for You

Tax payers with a household income of $80,000 or less are eligible. Visit one of our Tax Sites - no appointment necessary, to meet with one of our IRS Certified volunteer tax preparers. See below for details on who needs to be present and what paperwork you need to bring with you to file successfully. Call ahead to see which sites are busy and which ones have less of a wait time. (540) 373-0041

Tax Site Times & Locations - January 30-April 15, 2024

MONDAYS: Howell Library, 3:00pm-7:00pm (March 4-April 8) *** HOWELL SITE WILL BE CLOSED 04/08/24 ***

TUESDAYS: Downtown Fredericksburg Library, 3:00pm-7:00pm (January 30-April 9)

WEDNESDAYS: Porter Library, 3:00pm-7:00pm (January 31-April 10)

THURSDAYS: Rappahannock United Way, 1:00pm-5:00pm (February 1-April 11)

EVERY OTHER THURSDAY: Smoot Library, 3:00pm-7:00pm (February 8-April 4)

FRIDAYS: Rappahannock United Way, 9:00am-5:00pm (February 2-April 12)

SATURDAYS: Rappahannock United Way, 9:00am-5:00pm (February 3-April 13)

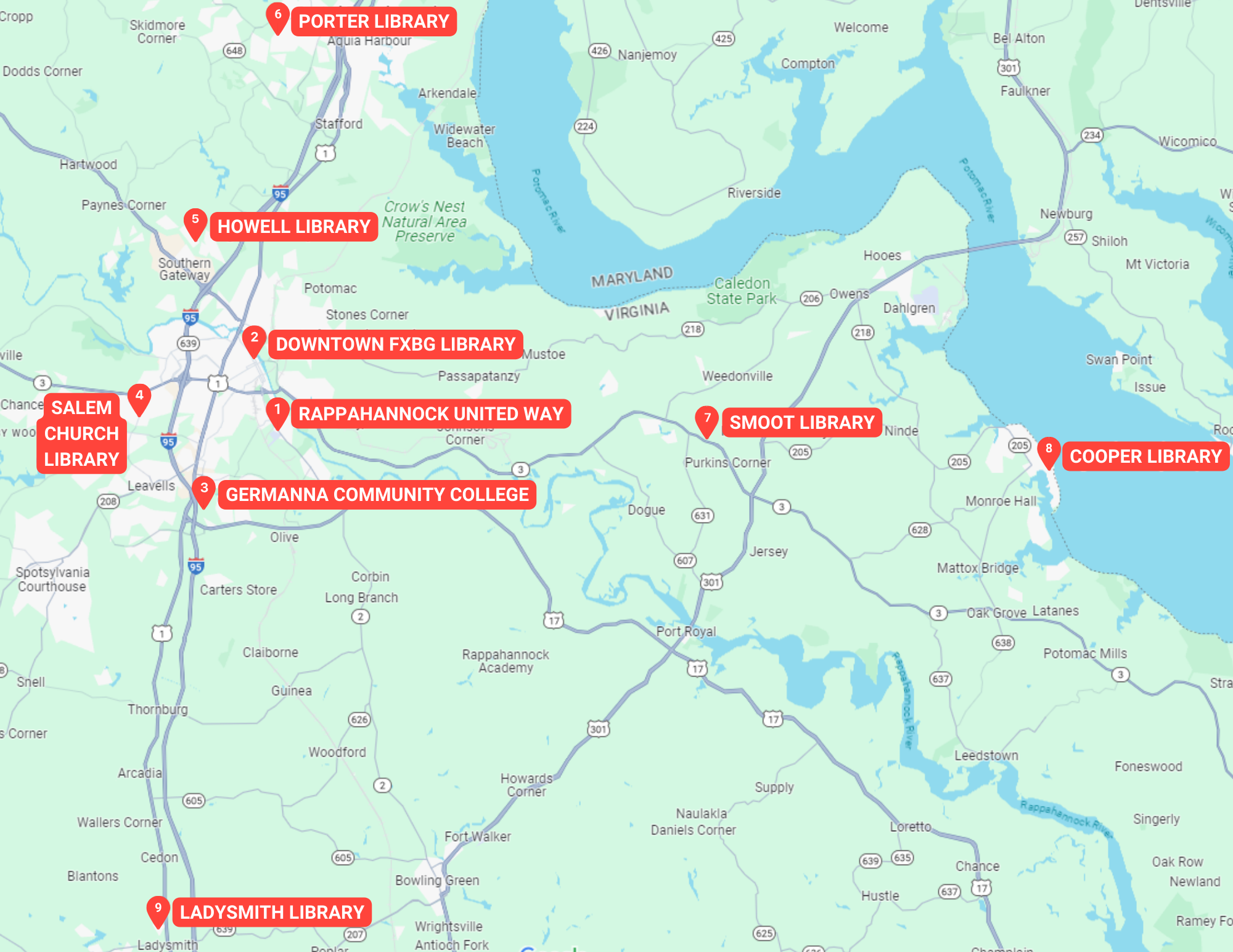

Tax Sites Map

Regular Tax Sites

1. Rappahannock United Way

3310 Shannon Park Drive

Fredericksburg, VA 22408

2. Downtown Fredericksburg Library

1201 Caroline Street

Fredericksburg, VA 22401

5. Howell Library

806 Lyons Boulevard

Fredericksburg, VA 22406

6. Porter Library

2001 Parkway Boulevard

Stafford, VA 22554

7. Smoot Library

9533 Kings Highway

King George, VA 22485

Special Tax Events in March & April Only

3. Germanna Community College

10000 Germanna Point Drive

Fredericksburg, VA 22408

March 14: 3:00-7:00pm

March 28: 3:00-7:00pm

April 11: 3:00-7:00pm

8. Cooper Library

20 Washington Avenue

Colonial Beach, VA 22443

March 2: 9:00-1:00pm

April 6: 9:00-1:00pm

9. Ladysmith Library

7199 Clara Smith Street

Ruther Glen, VA 22546

March 9: 9:00am-1:00pm

April 13: 9:00am-1:00pm

FAQs

Click your question below!

THINGS TO KNOW

Sponsors & Partners